Renters Insurance in and around San Francisco

Renters of San Francisco, State Farm can cover you

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Calling All San Francisco Renters!

No matter what you're considering as you rent a home - size, utilities, location, condo or house - getting the right insurance can be vital in the event of the unanticipated.

Renters of San Francisco, State Farm can cover you

Renting a home? Insure what you own.

Protect Your Home Sweet Rental Home

The unpredictable happens. Unfortunately, the personal belongings in your rented home, such as a bed, a cooking set and a couch, aren't immune to abrupt water damage or accident. Your good neighbor, agent Tiffany Won, is ready to help you figure out a policy that's right for you and find the right insurance options to protect your belongings.

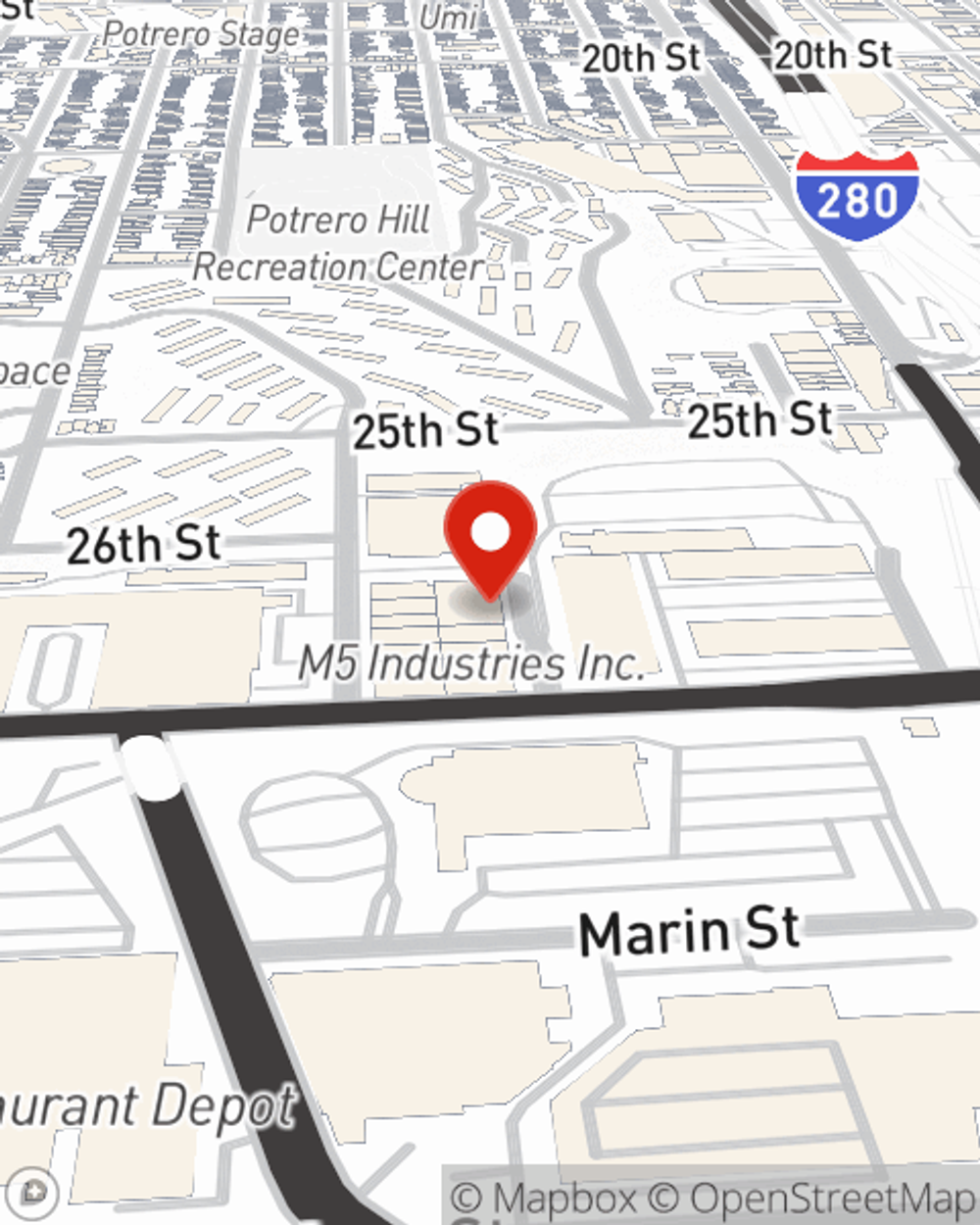

Contact State Farm Agent Tiffany Won today to discover how a State Farm policy can protect your possessions here in San Francisco, CA.

Have More Questions About Renters Insurance?

Call Tiffany at (415) 872-5734 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Tiffany Won

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.